|

Business Paper

Extraordinary Council Meeting

Alby Schultz meeting Centre, Cootamundra

11:00AM, Wednesday 3RD FEBRUARY, 2021

Administration Centres: 1300 459 689 |

|

Business Paper

Extraordinary Council Meeting

Alby Schultz meeting Centre, Cootamundra

11:00AM, Wednesday 3RD FEBRUARY, 2021

Administration Centres: 1300 459 689 |

|

Extraordinary Council Meeting Agenda |

3 February 2021 |

The Mayor & Councillors

Cootamundra-Gundagai Regional Council

PO Box 420

Cootamundra NSW 2590

NOTICE OF MEETING

An Extraordinary Meeting of Council will be held in the Alby Schultz meeting Centre, Cootamundra:

Wednesday, 3rd February, 2021 at 11:00AM

The agenda for the meeting is enclosed.

Phillip McMurray

General Manager

|

Extraordinary Council Meeting Agenda |

3 February 2021 |

AGENDA

5.1.1 Application for Special Rate Variation 2021

Council acknowledges the Wiradjuri people, the Traditional Custodians of the Land at which the meeting is held and pays its respects to Elders, both past and present, of the Wiradjuri Nation and extends that respect to other Aboriginal people who are present.

|

3 February 2021 |

|

DOCUMENT NUMBER |

342664 |

|||

|

REPORTING OFFICER |

Kay Whitehead, Interim Deputy General Manager |

|||

|

AUTHORISING OFFICER |

Phillip McMurray, General Manager |

|||

|

RELEVANCE TO COMMUNITY STRATEGIC PLAN |

|

|||

|

FINANCIAL IMPLICATIONS |

There are no Financial implications associated with this report. |

|||

|

LEGISLATIVE IMPLICATIONS |

Compliance with S508(A) of the Local Government Act, 1993. |

|||

|

POLICY IMPLICATIONS |

There are no Policy implications associated with this report. |

|||

|

1. Delivery Plan Addendum ⇩ 2. Long Term Financial Plan Addendum ⇩ |

|

1. That the Addendum to 2018-2021 Delivery Program and Long Term Financial Plan for 2020/21 to 2029/30 be adopted with incorporation of amendments arising from community consultation. 2. Council adopt the Rates and Financial Charges Hardship Policy and Debt Recovery policy as presented to the December 2020 meeting of Council. 3. Council make application to the Independent Pricing and Regulatory Tribunal (IPART) for a Special Rate Variation (SRV) under Section 508(A) of the Local Government Act 1993 to be permanently included in the rate base, of successive rate increases of 20%, 16%, 5% and 5%, commencing in 2021/22, amounting to a cumulative 53.5% increase over four years. 4. That, reflective of community feedback detailed in the report, IPART consider a mechanism for a review process to be undertaken in 12 months’ time following a determination of the Minister for Local Government in response to a proposal to demerge Cootamundra-Gundagai Regional Council (CGRC), without either CGRC or demerged Gundagai and Cootamundra Councils having to undergo another costly and emotionally challenging full SRV application process. 5. Council note the conclusion of community engagement on the proposal and acknowledge the community’s contribution in developing the final application. 6. Council continue to pursue operational efficiencies through continuing implementation of regular service reviews. 7. A further report be submitted to Council following IPART’s determination of Council’s application.

|

Introduction

At the Ordinary Meeting held 27th October 2020, Council resolved (Min. no.317/2020) to notify IPART of its intention to apply for a Special Rate Variation under S508(A) of the Local Government Act, 1993, (the Act) to be retained permanently in the rate base.

Subsequently, at an Extraordinary Meeting held 3rd December, 2020 Council resolved (Min. no. 412/2020) to endorse community consultation being undertaken in relation to a proposed SRV under Section 508(A) to be permanently included in the rate base, of successive rate increases of 19%, 18%, 5%, 5% and 5%, commencing in 2021/22, amounting to a cumulative 62.6% increase. The impact of the proposed rate increase on each rating classification was detailed in the report and in documentation mailed to all ratepayers and made available online.

Council resolved to undertake a range of community engagement activities in relation to the proposed SRV as detailed in the report submitted to the meeting, and that Professor Joseph Drew undertake further examination of ratepayer capacity to pay.

A Draft Addendum to Delivery Program 2018-2021, Long Term Financial Plan, and Rates and Financial Charges Hardship Policy and Debt Recovery Policy were placed on public exhibition.

Discussion

Council sought quotations for consultants to assist with the work, and Professor Drew was appointed.

Need for Special Rate Variation

In its adopted Operational Plan for 2020-2021, Council included a statement about proposed Special Rate Variation (SRV) as follows:

‘In January, 2020 Council engaged Professor Joseph Drew from the University of Technology Sydney to prepare a submission for the Local Government Boundaries Commission proposal to re-establish the pre-merger councils.

In preparing the submission, Professor Drew conducted a full review of Council’s finances. The review observed that Council’s rates are significantly lower than the average of our class (OLG Group 11) and recommended Special Rate Variations (SRV) of 17.5% in each of the 2021/22 and 2022/23 years and 10% in the 2023/24 year, before returning to the rate peg the following year.’

Council has updated fiscal data since the time of Professor Drew’s original report in light of the final results for 2019/20 and a review of 2020/21 budget year to date. Council has carefully re-examined its long term financial plan (LTFP) and asset management plans.

Some adjustments have been made to projections based on the Draft Financial Statements for 2019/20, and are consistent with the independent report produced by Deloitte Touch Tohmatsu (Deloitte report) for the Boundaries Commission (with data updated based on the Draft Financial Statements 2019/20 and budget review to date 2020/21) and the Financial Sustainability Report and Addendum prepared by Professor Joseph Drew (the Drew report). The Drew reports and Deloitte report are published on Council’s website for the information of the community.

The Draft Long Term Financial Plan (LTFP) and Draft Addendum to Delivery Program were placed on public exhibition following the Extraordinary Meeting held 3rd December, 2020.

Alternatives to an SRV that have been considered or are included in the LTFP include, (i) increase to non-regulated fees and charges, (ii) reduction to capital works, (iii) reduction to staff costs, (iv) increases to operating efficiency, (v) taking out of additional debt, and (vi) greater grant income. Despite these measures, without a SRV included in income the balance of unrestricted cash is predicted to reduce to zero around the end of the 2021/22 financial year.

CGRC comprehensively reviewed all of its non-regulated fees and charges before publication of its 2020/21 Operational plan. Fees were reviewed with emphasis placed on recovery according to supply-side marginal cost including full overheads.

As part of its efforts to dispel fiscal illusion Council engaged Professor Drew to conduct a thorough review of financial sustainability early 2020. This review included public meetings, a comprehensive report, and a series of information videos to explain local government finance matters to residents. The review flagged significant increases to rates (SRV), and was the catalyst for an efficiency drive prior to the finalisation of the 2020/21 budget. In addition, CGRC conducted rate harmonisation for the commencement of the 2020/21 year.

Capital renewal works for transport assets throughout the LTFP are lower, but not significantly so than those recommended by the Moloney report. Capital works included for the Buildings, Parks and Waste Asset class are not sufficient to prevent further increases in backlog. Capital works for transport assets have been reduced by $1 million in 2020/21 as a result of successful grant applications.

Council has already reduced staffing costs relating to consultants and overtime thus far in 2020/21. Moreover, Council plans to make a further reduction of $500,000 p.a. from 2022/23 onwards.

During preparation for the 2020/21 budget, Council did significant work to improve efficiency and is on target to realise savings in excess of $2 million. These savings will continue in the ensuing years.

Council has drawn down $8.4 million dollars of debt (for major water and sewerage works and plant purchase). The LTFP to support this SRV involves an additional general fund debt of $1 million to meet matching grant criteria for transport infrastructure.

The purpose of this SRV application is to try to assure financial sustainability, with a view to maintaining service levels wherever possible, in response to very significant cost pressures imposed by the May 2016 forced amalgamation and subsequent rate path freeze.

Consultation Activities

The table below outlines the activities which Council has undertaken in order to provide opportunities for residents to share their thoughts on the SRV proposal.

|

Date |

Engagement |

Target Audience |

|

18/12/20 |

Mail-out to all ratepayers with reply paid envelope. |

All ratepayers (approximately 6,500) |

|

18/12/20 |

Comprehensive Fact Sheet. |

Included in aforementioned mail-out and also posted to the Council website. |

|

18/12/20 |

First Survey. |

Included in mail-out to all ratepayers. Also available at Council offices and online. Return date set at Tuesday 12th January, 2021, however late surveys accepted. 534 surveys returned to Council which is a return rate of 8.3%. |

|

16/12/20 |

Media Release. |

All consumers of regional media communications. |

|

11/12/20 |

Piece in Council Christ-mass newsletter. |

All residents. |

|

11/12/20 |

Paid Advertising. |

Readers of major local newspapers – Cootamundra Times, and Gundagai Independent. |

|

18 and 19/1/21 |

Community Meetings. One held in each of the major towns as detailed in the Fact Sheet. |

All ratepayers, residents and interested parties. |

|

18 and 19/1/21 |

Citizen Juries. One in each of the major towns as detailed in the Fact Sheet. |

12 people selected at random from 46 and 19 Expressions of Interest completed by Cootamundra and Gundagai residents respectively. Workshop duration of over five hours, culminating in a written jury verdict. |

|

20 and 21/1/21 |

All day listening posts in each major town as detailed in the Fact Sheet. |

All people able to travel to town. A record of all interactions is included in the Register of SRV contacts. |

|

16/12/20 |

Information Videos to accompany Fact Sheet and Survey. |

All people able to access the internet. Videos were also available for viewing at Council offices and the listening posts. |

|

18 and 19/1/21 |

Post Community Meeting survey. |

All attendees at the open invitation Community Meetings. |

|

From 18/12/20 Onwards |

Comprehensive reports on financial sustainability (‘need’), capacity to pay, debt capacity, and efficiency. |

Available on the Council website, at Council Offices and at the listening posts. Referred to in the community meetings and citizen juries. |

Outcomes of Consultation

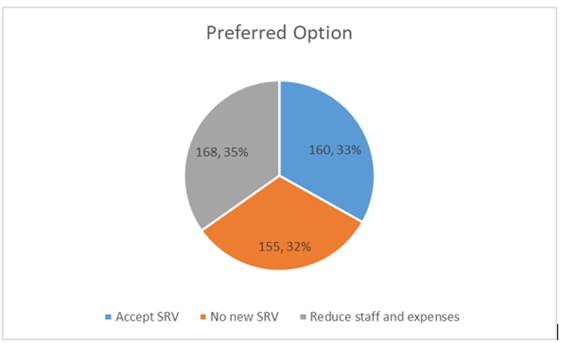

The first survey was completed in response to information provided in Council’s information mail-out, fact sheet, media releases, newsletter, and information available online. 534 surveys were returned of approximately 6,500 posted out. Responses were divided as shown in the following pie graph, with approximately one third of respondents accepting the proposed SRV, one third opposing the proposed SRV, and the remainder indicating Council should reduce staff and recurrent costs. Many surveys indicated a preference to demerge. 94% of respondents indicated they were aware of options for further information, 76% indicated they were aware of the need for a SRV and 90% responded that they were aware of the effect of the proposed SRV on average rates in each category.

The responses to this first survey informed presentation material for the citizen juries and the community meetings, and a second survey was prepared for distribution at these consultations.

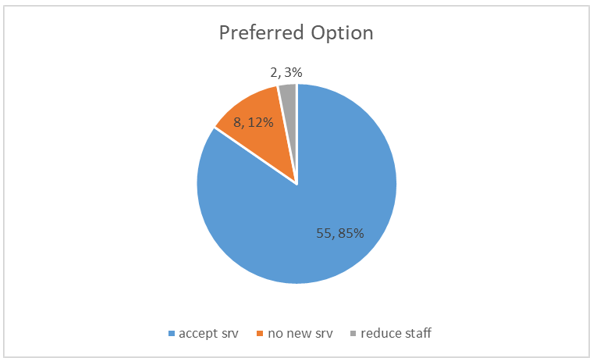

Around 36 surveys were returned from the Gundagai meeting and 34 from the Cootamundra meeting. However counts on the night suggested there were around 60 people in attendance at the Cootamundra meeting. Each community meeting took around two hours and included a presentation of around eighty minutes as well as a Question & Answer session. With more comprehensive information there was overwhelming support in favour of the proposed SRV when asked the same question that appeared in the first survey per the pie chart below. Respondents were asked whether they had filled out the first survey, and if so, whether their response had changed. Just over two thirds of respondents indicated their position had changed, indicating the effectiveness of the community meetings and Council’s engagement strategy.

There was strong feedback that respondents wanted Council to be accountable for producing greater efficiencies. Once again there was strong feedback that a demerger should be sought. In particular, responses urged IPART to approve the SRV and also somehow acknowledge the community’s preference for a de-amalgamation.

The Cootamundra Jury comprised 11 people. The jury received comprehensive information from Professor Drew for approximately 2 hours and then called a number of ‘witnesses’, including the General Manager, Manager of Finance, Mayor and Deputy Mayor. The jurors were given opportunity to alter the Long Term Financial Plan to model different SRV possibilities. The jury was then asked to write a joint verdict in which they answered 12 questions.

11 of 12 jurors agreed with the need for an SRV, but preferred slightly different rises and timing for the increases. As a group, they suggested a four year cumulative increase of 53.5% (totalling 57.3% over 5 years compared to the original proposal for 62.6% over 5 years) was appropriate (20%, 16%, 5%, 5%). The jurors’ willingness to pay was contingent on a number of matters including ‘buy-in’ by Councillors and senior executives, improved efficiency, better work culture, better use of technology, and de-amalgamation. Jury members were understandably concerned about peoples’ capacity to pay, hence the proposal for a lower SRV. The jury agreed that Council had taken sufficient measures to ensure citizen awareness. The jury took just over 6 hours to complete.

The same process was undertaken the following day for a Gundagai Jury. Jurors called the Manager of Finance, General Manager, Mayor and a Councillor to give evidence.

After evidence was received Professor Drew again used the modified version of the LTFP and encouraged jurors to experiment with various options. However, there was a strong feeling that a de-amalgamation was non-negotiable and that only a single year would be consented to unless the de-amalgamation was approved and executed. Professor Drew urged the jury to think carefully about their decision and consider what would happen if the de-amalgamation was not forthcoming, emphasising the likelihood of being placed into financial administration and the negative effects of doing so. Professor Drew also outlined the high costs involved in pursuing a SRV, at a later time, as well as the disruption to the community. However, the process was an independent one and the jurors proceeded to give their verdict of just 25% for one year only. All of the verdicts were unanimous and strongly advocated for by the jury. The Gundagai jury felt that the situation they are now faced with is entirely the result of bad public policymaking back in May 2016. They urged the State government to act ethically and compensate the community for the fiscal damage done to them. The jury process took just over five-and-a-half hours to complete.

Following this second jury outcome, Professor Drew approached individual Cootamundra jurors seeking further feedback. 7 of the jurors agreed that there should be a mechanism enshrined in the IPART approval instrument to require Council to re-engage with the community after the first year, which would fall after the Minister’s determination following the Boundaries Commission findings – ie the community would then know whether the preferred demerger would go ahead. It was also considered that this would provide Council with strong incentive to demonstrate further efficiencies and cost reductions. 1 Cootamundra juror agreed with the Gundagai jury proposal for a single year 25% increase, and 2 jurors continued to endorse the Cootamundra jury finding. 1 juror said ‘no SRV’ and ‘immediate de-amalgamation’.

Two full day listening posts were conducted in each of Cootamundra and Gundagai and a number of casual contacts were made and recorded with customer service staff and councillors. In all, 80 contacts were recorded in a register with similar responses and comments.

Summary of consultation

There are a number of common themes throughout the consultation:

1. There is a general acceptance that CGRC does require additional revenues in order to address a structural budget imbalance.

2. There is a general consensus that CGRC needs to do more work on efficiency and cost control.

3. There seems to be a genuine fear that CGRC may not vigorously pursue all efficiency options if the whole SRV is approved without conditions.

4. People do want Council to demonstrate that they can reduce costs even more aggressively than outlined in the Fact Sheet.

5. Many ratepayers blame the merger for the need for an SRV, and would prefer to demerge, and a number state they will only accept an SRV if a demerger proceeds.

6. All parties have expressed a frustration with the delays by the Boundary Commission and Minister.

7. Most people do want to avoid the pecuniary and emotional cost of a subsequent SRV next year, if at all possible.

Impact on Affected Ratepayers

Professor Drew has undertaken an econometric review of CGRC residents’ capacity to pay local government rates. In summary, this study concluded that the community does have the capacity to pay additional taxation. Professor Drew’s detailed report is published on Council’s website.

However, it was acknowledged by Professor Drew and clearly articulated in responses to community engagement, that many people were unhappy about the advertised proposed increases, particularly following rate harmonisation implemented in 2020/21.

Modification of Proposal

As a result of feedback from community consultation, a modified proposal for SRV is now put forward in the tables below for Council’s consideration. This proposal will leave Council with a lot of work still to do to achieve financial sustainability, but will provide adequate cash reserves over the coming years in order for Council to undertake ongoing service reviews to improve productivity and contain recurrent costs, which has been shown to be an important consideration for residents.

The recommendation now put before Council is that Council make application to IPART for a Special Rate Variation under Section 508(A) to be permanently included in the rate base, of successive rate increases of 20%, 16%, 5%, and 5%, commencing in 2021/22, amounting to a cumulative 53.5% increase over four years.

To use the same timescale to compare the proposed SRV with the proposal originally advertised – ie over 5 years, the modified proposal amounts to a total increase of 57.3% over 5 years (20%, 16%, 5%, 5%, 2.5%) compared with advertised proposal totalling 62.6% over 5 years (19%, 18%, 5%, 5%, 5%).

In view of the themes listed in dot points 1 to 7 above, it is also recommended that IPART consider imposing a condition under S508A(4) to provide a mechanism for a review process to be undertaken in 12 months’ time, following determination of the Minister in response to the proposal to demerge Cootamundra Gundagai Regional Council, without either CGRC or a demerged Gundagai and Cootamundra Council having to undergo another costly and emotionally challenging full SRV application process.

It is unclear whether s508(A) gives IPART power to impose such a condition, but the recommendation draws IPART’s attention to issues raised during the consultation, including the possibility that CGRC may be demerged to the former Gundagai and Cootamundra Councils.

Professor Joseph Drew has put forward for Council’s consideration a more detailed and more specific recommendation which is reproduced below:

‘Council has decided to apply for a Special Rate Variation of 53.5% cumulative over four years, including the assumed rate cap as detailed below:

2021/22: 20.0%

2022/23: 16.0%

2023/24: 5.0%

2024/25: 5.0%

The SRV application will also request that the Independent Pricing and Regulatory Tribunal uses its powers under s508A(4) of the Act (1993) to stipulate on the approval instrument that Council (or emerging de-amalgamated Councils) re-engage with the community via a postal survey sometime proximate to May 2022 before levying the final three parts of the proposed SRV. To be able to levy these final three parts Council will need the majority of completed surveys returned by the due date to indicate consent. It is envisaged that by this time Council will have demonstrated the required efficiencies and also that the Minister will have made her decision known regarding the proposal to de-amalgamate Cootamundra-Gundagai Regional Council.’

Staff do not recommend Professor Drew’s proposal for the following reasons:

The staff recommendation flags the possibility that CGRC may be demerged and community concerns in that regard, allowing IPART to consider this issue in its determination and whether conditions may be applied.

The application for this substantial rate increase is made following community consultation because it is Council’s considered opinion that the increase is required for ongoing financial sustainability of CGRC. Staff cannot endorse a recommendation that could put CGRC’s financial position in jeopardy. Financial and legal implications of a demerger would need to be further considered in any case in the event the Minister for Local Government approves the demerger proposal.

While the modified proposal now recommending a cumulative SRV of 53.5% is based on a broad range of community feedback, the only consultation on the Professor Drew proposal for community survey after 12 months has been with 23 jury members in Cootamundra and Gundagai, a small number when compared with the 684 comments and surveys received by Council in response to the advertised proposal.

In the event Council’s application for SRV is successful, Council can in any case, determine not to apply the full amount of the increase and has up to 10 years to apply ‘catch up’ increases within the limit of the approved SRV. IPART has also advised that Council can request that IPART revoke the SRV instrument at any time.

Council is at liberty to override any staff recommendation by resolution.

Impact on Rating

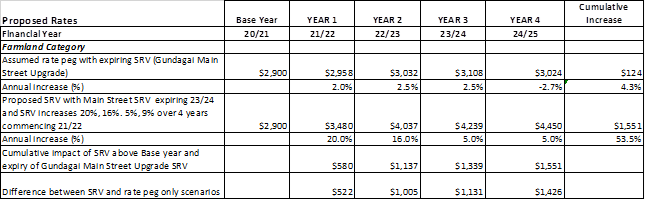

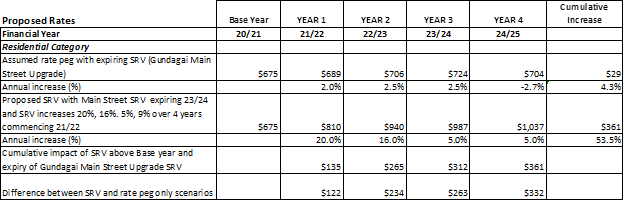

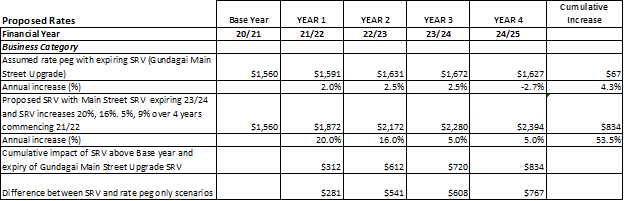

The impact of the proposed SRV on the average rates in each of the Residential, Business and Farmland rating categories is summarized in the Addendum to 2018-2021 Delivery Program and in the following tables.

Table 1. Impact on Average Farmland Rate of an Expiring Special Rate Variation and s508A Special

Variation of 20%, 16%, 5%, 5%.

Table 2. Impact on Average Residential Rate of an Expiring Special Rate Variation and s508A Special Variation of 20%, 16%, 5%, 5%.

Table 3. Impact on Average Business Rate of an Expiring Special Rate Variation and s508A Special Variation of 20%, 16%, 5%, 5%

The effect of the reduced SRV proposal for cumulative rate increases of 53.5% over four years when compared to the original SRV proposal for cumulative rate increases of 62.6% over five years is to reduce cumulative notional rates income by $401,736 by 2025/26. This is a comparison after 5 years so we are comparing apples with apples, although the recommended SRV only increases rates by 2.5% (rate peg) in the fifth year. The average farmland ratepayer’s rate account will be lower by $152 per annum, residential lower by $35 per annum and business lower by $82 per annum for the recommended proposal when compared with the proposal advertised for community consultation.

The effect of the recommended change is thus quite significant, but takes into account community feedback that the original proposal would cause financial stress to some CGRC ratepayers, particularly given the rate shock already experienced by many due to rates harmonization. Community feedback also strongly expressed the view that Council should work harder to achieve more productivity improvements and cost reductions.

Full modelling of the difference between the advertised SRV proposal and the modified proposal for SRV recommended in this report is contained in the LTFP attached to this report.

Policies and Plans on Exhibition

Draft Addendum to Delivery Program 2018-2021, Long Term Financial Plan, and Rates and Financial Charges Hardship Policy and Debt Recovery Policy were placed on public exhibition in December 2020 in conjunction with other documents for community consultation. It is recommended that these documents now be formally adopted with incorporation of amendments following community consultation.