|

Business Paper

Extraordinary Council Meeting

Alby Schultz meeting Centre, Cootamundra

5PM, Thursday 3RD DECEMBER, 2020

Administration Centres: 1300 459 689 |

|

Business Paper

Extraordinary Council Meeting

Alby Schultz meeting Centre, Cootamundra

5PM, Thursday 3RD DECEMBER, 2020

Administration Centres: 1300 459 689 |

|

Extraordinary Council Meeting Agenda |

3 December 2020 |

The Mayor & Councillors

Cootamundra-Gundagai Regional Council

PO Box 420

Cootamundra NSW 2590

NOTICE OF MEETING

An Extraordinary Meeting of Council will be held in the Alby Schultz meeting Centre, Cootamundra

on:

Thursday, 3rd December, 2020 at 5pm

The agenda for the meeting is enclosed.

Phillip McMurray

General Manager

|

Extraordinary Council Meeting Agenda |

3 December 2020 |

AGENDA

Council acknowledges the Wiradjuri people, the Traditional Custodians of the Land at which the meeting is held and pays its respects to Elders, both past and present, of the Wiradjuri Nation and extends that respect to other Aboriginal people who are present.

|

3 December 2020 |

4.1.1 Proposal to proceed with consultation for a Special Rate Variation (SRV) under Section 508 (a) of the Local Government Act, to be retained permanently in the rate base

|

DOCUMENT NUMBER |

340204 |

|||

|

REPORTING OFFICER |

Kay Whitehead, Interim Deputy General Manager |

|||

|

AUTHORISING OFFICER |

Phillip McMurray, General Manager |

|||

|

RELEVANCE TO COMMUNITY STRATEGIC PLAN |

|

|||

|

FINANCIAL IMPLICATIONS |

There are significant financial implications as detailed in the report. |

|||

|

LEGISLATIVE IMPLICATIONS |

There are no Legislative implications associated with this report. |

|||

|

POLICY IMPLICATIONS |

There are no Policy implications associated with this report. |

|||

|

1. Draft addendum to 2018-2021 Delivery Program 2. ⇩ Draft Long Term Financial Plan (LTFP) (Late, under separate cover, to be provided 2/12/20) |

|

1. Council adopt the Draft Addendum to 2018-2021 Delivery Program and Draft Long Term Financial Plan for 2020/21 to 2029/30 for public exhibition for a period of no less than 28 days. 2. Council endorse community consultation being undertaken in relation to proposed SRV under Section 508(A) to be permanently included in the rate base, of successive rate increases of 19%, 18%, 5%, 5% and 5%, commencing in 2021/22, amounting to a cumulative 62.6% increase per the tables in this report. 3. Council undertake Community Engagement Activities in relation to the proposed SRV as detailed in the report. 4. Professor Drew undertake further examination of ratepayer capacity to pay as detailed in the Draft Addendum to Delivery Program and in the report. 5. Council continue to pursue organisational efficiencies through continued implementation of regular service reviews; and 6. A further report be prepared for Council following conclusion of community consultation. |

Introduction

Council has reviewed its long term financial plan following completion of the 2019/20 annual financial statements which confirms the need for application for a Special Rate Variation. This report details the reasons, the effect on ratepayers, and the proposed Engagement Strategy to ensure ratepayers are properly consulted. A further report and resolution will be required before Council formally commits to an application to IPART for Special Rate Variation.

Discussion

At its meeting held 27 October 2020, Council resolved to notify IPART of Council’s intention to apply for a Special Rate Variation under Section 508(A) of the Local Government Act, 1993, to be retained permanently in the rate base.

Council sought quotations for consultants to assist with the work, and Professor Drew was appointed. Preliminary work has commenced.

NEED FOR SPECIAL RATE VARIATION

In its adopted Operational Plan for 2020-2021, Council included a statement about proposed Special Rate Variation (SRV) as follows:

‘In January 2020 Council engaged Professor Joseph Drew from the University of Technology Sydney to prepare a submission for the Local Government Boundaries Commission proposal to re-establish the pre-merger councils.

In preparing the submission, Professor Drew conducted a full review of Council’s finances. The review observed that Council’s rates are significantly lower than the average of our class (OLG Group 11) and recommended Special Rate Variations (SRV) of 17.5% in each of the 2021/22 and 2022/23 years and 10% in the 2023/24 year, before returning to the rate peg the following year.’

Council has updated fiscal data since the time of Professor Drew’s original report in light of the final results for 2019/20 and a review of 2020/21 budget year to date. Council has carefully re-examined its long term financial plan (LTFP), and asset management plans. A detailed discussion of measures already taken and proposed is included in the Draft Long Term Financial Plan (LTFP) attached to this report.

Alternatives to a SRV that have been considered or are included in the LTFP include, (i) increase to non-regulated fees and charges, (ii) reduction to capital works, (iii) reduction to staff costs, (iv) increases to operating efficiency, (v) taking out of additional debt, and (vi) greater grant income. Despite these measures, without a SRV included in income the balance of unrestricted cash is predicted to reduce to zero around the end of 21/22.

CGRC comprehensively reviewed all of its non-regulated fees and charges before publication of its 2020-21 Operational plan. Fees were reviewed with emphasis placed on recovery according to supply-side marginal cost including full overheads.

As part of its efforts to dispel fiscal illusion Council engaged Professor Drew to conduct a thorough review of financial sustainability early 2020. This review included public meetings, a comprehensive report, and a series of information videos to explain local government finance matters to residents. The review flagged significant increases to rates (SRV), and was the catalyst for an efficiency drive prior to the finalisation of the 2020-21 budget. In addition, CGRC conducted its rate harmonisation for the commencement of the 2020-21 year.

There is little scope to reduce the scale of expenditure on capital works as there is quite a large extant backlog. Some of this backlog is being addressed through extensive water works in Cootamundra, and sewer works in Gundagai (although these are funded from reserves and borrowings, not General Funds). In the LTFP appended we have reduced capital works for transport assets, where there is relatively less backlog, by $1 million in 2020/21.

Council has already reduced staff costs relating to consultants and overtime thus far in 2020/21. Moreover, we plan to make a further reduction of $500,000 p.a. from 2022/23 onwards.

During preparation for the 2020/21 budget, Council did significant work to improve efficiency and is on target to realise savings in excess of $2 million. These savings will continue in the later years.

Council has drawn down $8.4 million dollars of debt (for major water and sewerage works and plant purchase). The LTFP to support this SRV involves an additional general fund debt of $1 million to meet matching grant criteria for transport infrastructure.

The draft LTFP incorporates all the above measures, and the proposed SRV will result in rate increases (including expiring Gundagai Main Street SRV) of 19%, 18%, 5%, 5%, 5% over five years commencing 21/22.

The purpose of this SRV application is to try to assure financial sustainability, with a view to maintaining service levels wherever possible, in response to very significant cost pressures imposed by the May 2016 forced amalgamation and subsequent rate path freeze.

IMPACT ON RATING

The impact of the proposed SRV on the average rates in each of the Residential, Business and Farmland rating categories is summarised in the Addendum to 2018-2021 Delivery Program and in the following tables.

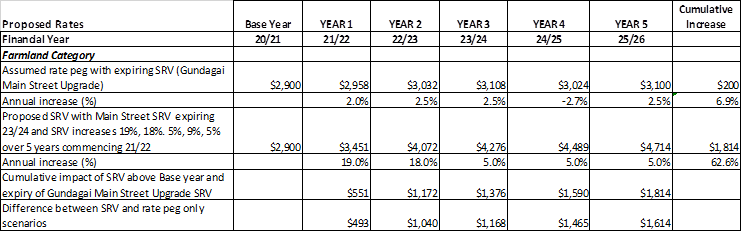

Table 1. Impact on Average Farmland Rate of an Expiring Special Rate Variation and a s508A Special Variation of 19%, 18%, 5%, 5%, 5%

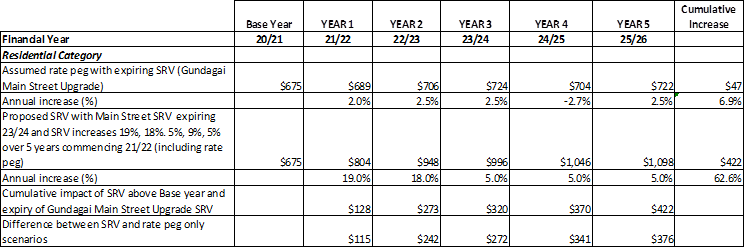

Table 2. Impact on Average Residential Rate of an Expiring Special Rate Variation and a s508A Special Variation of 19%, 18%, 5%, 5%, 5%

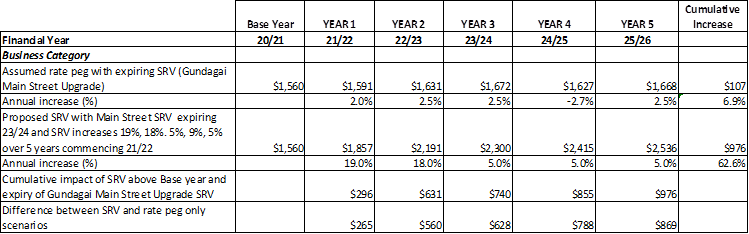

Table 3. Impact on Average Business Rate of an Expiring Special Rate Variation and a s508A Special Variation of 19%, 18%, 5%, 5%, 5%

ENGAGEMENT STRATEGY

IPART (2020) requires Councils to use a variety of communication strategies and states that these must be responsive to the magnitude and permanency of the proposed SRV. The CGRC SRV is very high and thus will require almost all of the suggested strategies. The following strategies are proposed:

1. A mail-out to all ratepayers. This is the only way to ensure that all people directly affected by the changes are advised. We should include the average change tables, clearly state that it is a permanent change, clearly articulate that future rate pegs will be calculated according to the year 5 (2025/26) levels as base year, note that the SRV for the main street upgrade would have otherwise expired at the end of 2023/24 (and the relative effect of this), the other options and cost containment strategies that we have adopted, state that the average rate may differ to specific properties, and explain why the proposal is the most appropriate option. All of these things are required and laid-out in the aforementioned IPART (2020) document. The mail out will also include a survey form, notice of public meeting, expression of interest in participating in a citizen jury, and a return-paid envelope (this latter device is specifically mentioned by IPART (2020)). The mail out needs to be out by the 18th of December.

2. Fact sheet. A Fact Sheet will be displayed prominently on the council website and be part of the mail out. A fact sheet ensures that everyone has clear and precise information for decision-making according to the IPART instructions.

3. Media Release. The fact sheet and material sent out to ratepayers should form the basis of a media release issued by Council in the first week of January.

4. An online survey is not recommended given that we are already mailing out a survey. Many of the most vulnerable residents do not have access to the internet and multiple channels for surveys introduces a high risk of biased survey results (for example, where a person might submit both a written and online survey).

5. Public meetings. Professor Drew will conduct two public meetings after hours on Monday the 18th and Tuesday the 19th of January, 2021 respectively. This ensures people with standard working hours have an opportunity to ask questions and provide direct feedback.

6. Resident workshops. Professor Drew will conduct two citizen juries during standard working hours on Monday 18th and Tuesday the 19th January, 2021. These juries need to be held during work hours so that citizens can call up Council ‘witnesses’ should they choose to do so. Citizen juries are a technique from the scholarly literature where twelve people from each community first hear a presentation from Professor Drew, then interrogate the information presented, interview Council representatives and executives as required, and finally formulate a report to the community which should be displayed on the Council website and perhaps provided to the media. It ensures that randomly selected[1] and fully informed members of the community can have a prominent voice on the matter before them.

7. Listening Posts. These should be conducted for the whole week of 18-22 January inclusive to coincide with the public meetings and citizen juries.

8. Professor Drew recommends against online discussion forums. First, because the ABS (2020) reports that just 69.3% of the community has access to the internet and it is likely that vulnerable demographics will not be able to participate. Second, because forums of this kind can easily encourage misinformation and hateful speech under the perceived anonymity of the internet. Third, it should be noted that in monitoring online forums there is a heightened risk that staff members might accidentally provide information that is not consistent with the strict OLG or IPART guidelines.

9. Discussions with particular community groups. Given the political sensitivities in the community and also the fact that we are providing multiple pathways for engagement, this channel of communication is not recommended.

10. Videos: This is an additional resource we will provide to the community. The videos outlining the SRV should be made available on the Council website and should be played at the listening posts in order to ensure wide exposure and also stimulate comment.

CRITERIA REQUIRED FOR THE SPECIAL RATE VARIATION APPLICATION

The criteria for assessing the SRV are outlined in the OLG (2020) Guidelines for the Preparation of an Application for a Special Variation to General Income.

1. The need for, and purpose of, a different revenue path for the council’s General Fund is clearly articulated and identified in the council’s IP&R documents.

2. Evidence that the community is aware of the need for and extent of a rate rise

3. The impact on affected ratepayers must be reasonable

4. The relevant IP&R documents must be exhibited, approved and adopted by Council

5. The IP&R documents or the Council’s application must explain the productivity improvements and cost containment strategies

Adoption of the Draft Delivery Program Addendum and Long Term Financial Plan attached to this report will address many of the issues identified in the Guidelines. The programmed Community Consultation and Review of Capacity to Pay will assist Council with a detailed, well-grounded application.

If Council’s application fails to address all issues to the satisfaction of the IPART Tribunal, Council’s application may be refused, or approved to a lesser extent. As previously advised, if Council applies for and is approved for an SRV, but elects not to increase rates to the full extent of the approved SRV, it has up to 10 years to “catch up” on the collection of the rates income.

ADDITIONAL TASKS

Professor Drew will be undertaking a number of additional tasks to ensure a thorough and well-grounded application:

A. An econometric analysis of capacity to pay local government taxation based on data drawn from the entire state over a five year panel of data

B. Updating the financial sustainability review document prepared for Council earlier this year so that it includes 2020/21 data and is reflective of the SRV proposal

C. Updating the local and global intertemporal data envelopment analyses to demonstrate improvements to efficiency already realized

D. Conducting an econometric debt capacity analysis based on the entire state over a five year panel of data

E. Council’s Finance Manager will be constructing and graphing the key OLG ratios for the next ten years under the ‘status quo’ and ‘proposed SRV’ scenarios