|

Business Paper Late Reports Ordinary Council Meeting

Council Chambers, Gundagai

6:00PM, Tuesday 28th July, 2020

Administration Centres: 1300 459 689 |

|

Business Paper Late Reports Ordinary Council Meeting

Council Chambers, Gundagai

6:00PM, Tuesday 28th July, 2020

Administration Centres: 1300 459 689 |

|

Ordinary Council Meeting Agenda |

28 July 2020 |

LATE REPORTS

8.1.9 Local Government NSW Annual Conference 2020 - Late Report

8.2.5 2020/21 Rates and Annual Charges - Late Report

8.2.6 2020/21 Rates and Amended Annual Charges - Late Report

|

Ordinary Council Meeting Agenda |

28 July 2020 |

|

DOCUMENT NUMBER |

331325 |

|||

|

REPORTING OFFICER |

Marianne McInerney, Personal Assistant to the General Manager |

|||

|

AUTHORISING OFFICER |

Phillip McMurray, General Manager |

|||

|

RELEVANCE TO COMMUNITY STRATEGIC PLAN |

|

|||

|

FINANCIAL IMPLICATIONS |

The cost of registration and accommodation per attendee |

|||

|

LEGISLATIVE IMPLICATIONS |

There are no Legislative implications associated with this report. |

|||

|

POLICY IMPLICATIONS |

There are no Policy implications associated with this report. |

|||

|

1. Invitation for Phillip McMurray to Attend the NSW Annul Local Government Conference 22-24 November 202 ⇩ 2. Draft Programme for the Local Government NSW Annual Conference 2020 ⇩ |

|

1. Council nominate attendees for the Local Government NSW Annual Conference, 2020. 2. Council’s voting delegates for the Local Government NSW Annual Conference, 2020 be nominated. |

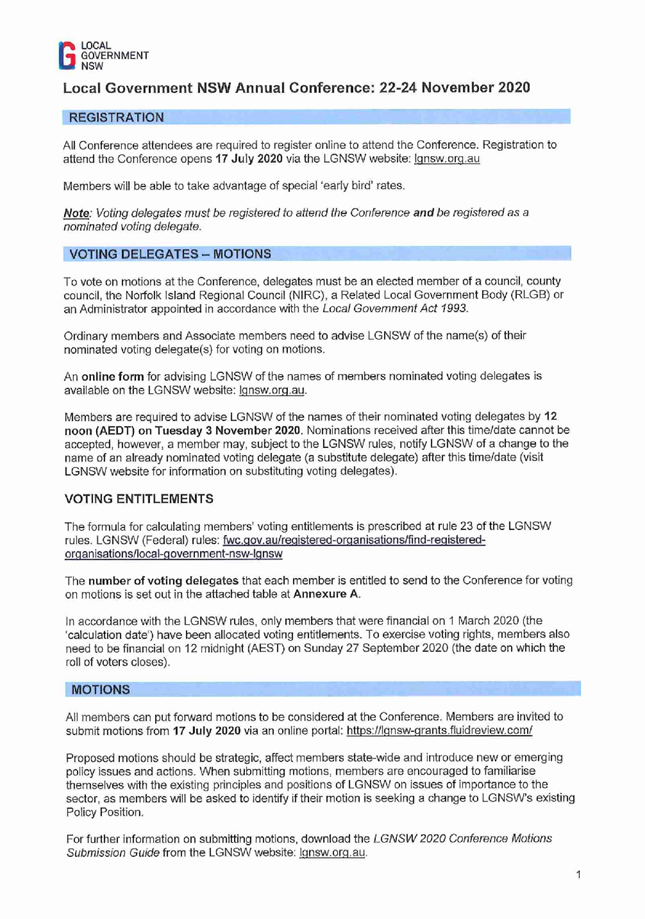

Introduction

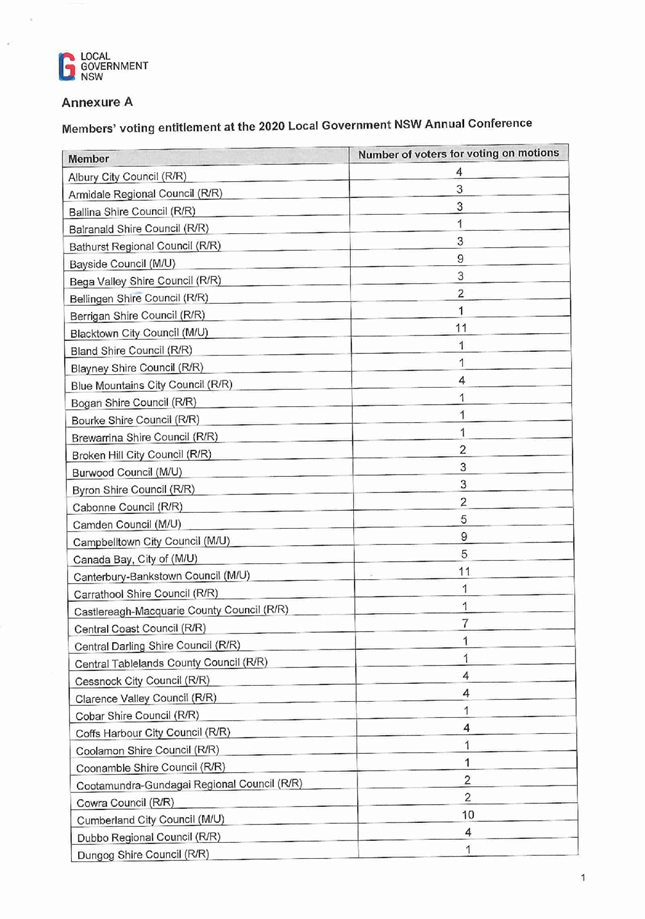

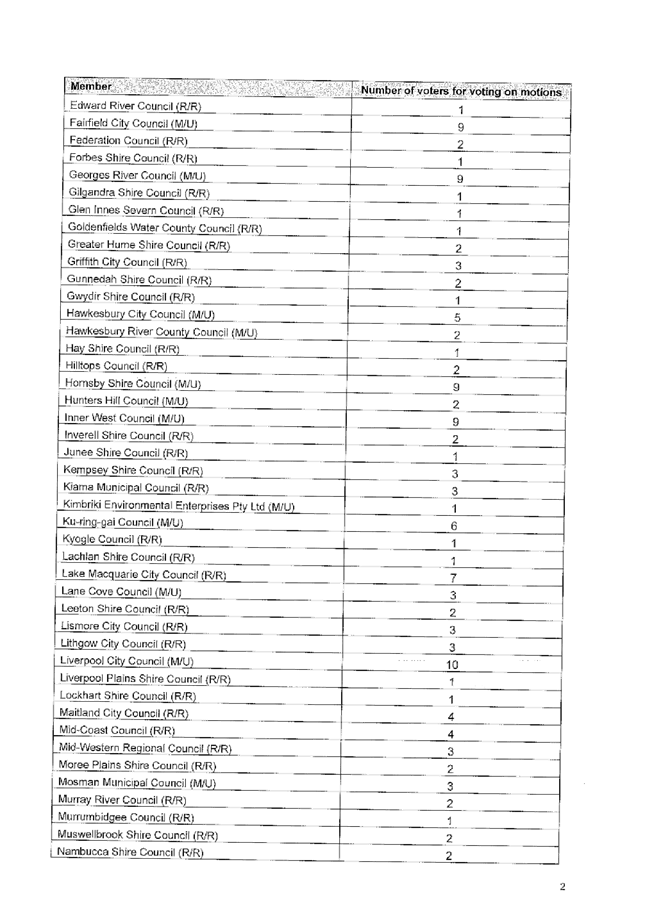

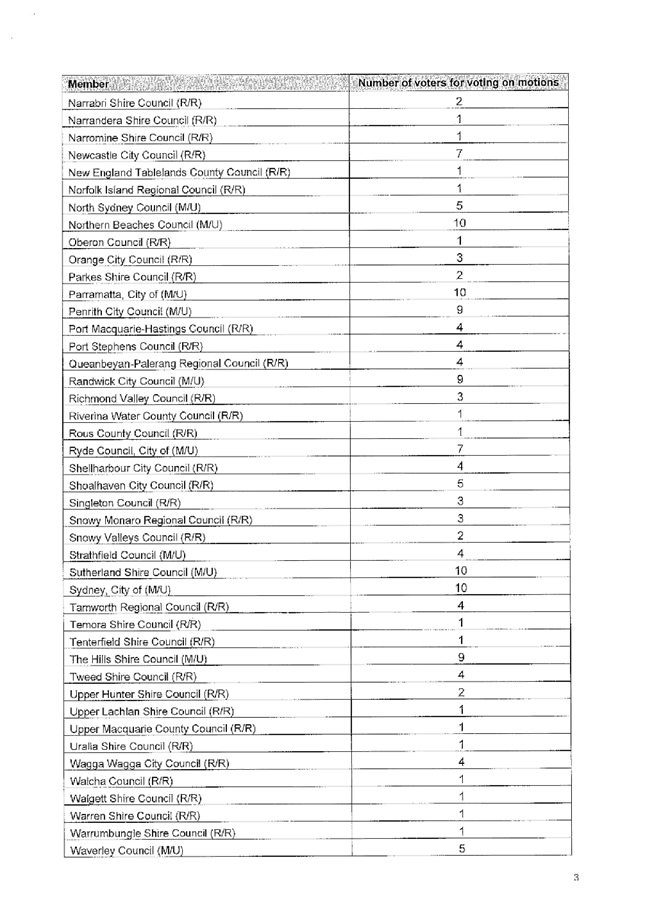

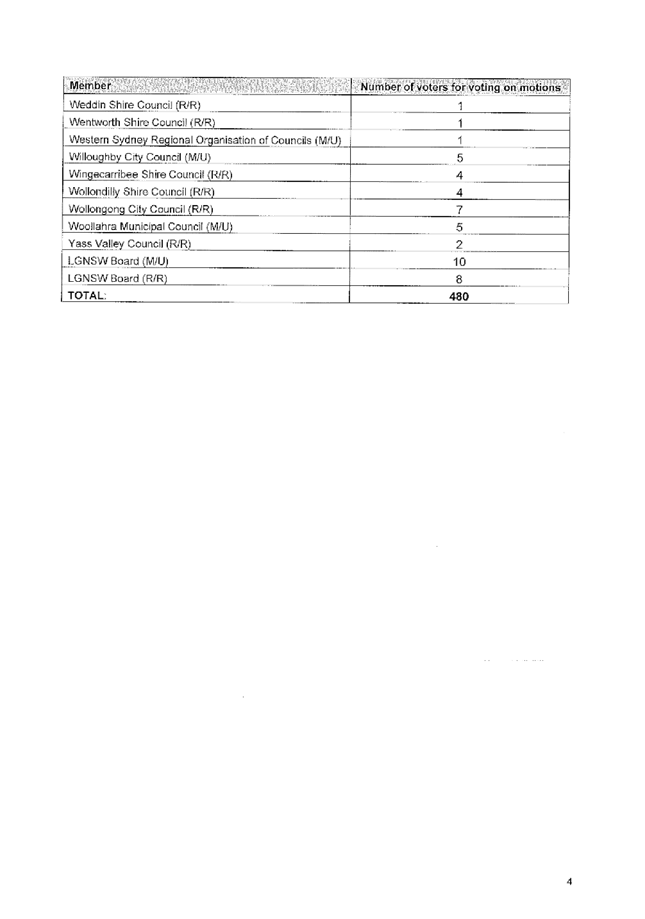

This Conference is the annual policy making event for NSW general purpose councils and its associate members. It is the pre-eminent event of the local government year where local councillors come together to share ideas and debate issues that shape the way the state is governed at a local level.

Discussion

The Local Government NSW Annual Conference will be co-hosted by the Liverpool City Council and will be held Sunday 22nd to Tuesday 24th November, 2020. Conference registration opened Monday, 15th July, 2019.

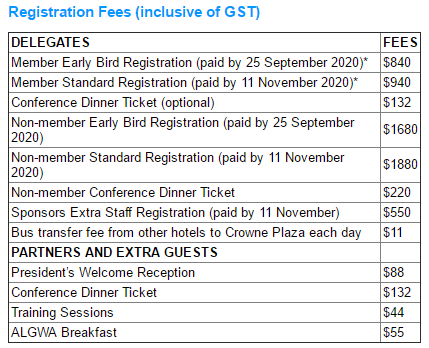

This year’s registration fees are listed in a table on the following page. As Council will be registered the within the Early Bird registration period the registration fee will be $840.00 per delegate. Accommodation of three (3) rooms has already been booked at a cost of $259 per room per day.

The fees indicated above show that the cost in full for attendance with registration , conference dinner, one training session, ALGWA Breakfast and accommodation is $1848 per person.

Two voting delegates must be registered for the voting on motions during the formal business sessions. The details of the voting delegates must be determined and submitted by no later than Midnight (AEST), Friday, 20th September, 2019. At previous annual conferences the voting delegates have been the Mayor and Deputy Mayor.

|

28 July 2020 |

|

DOCUMENT NUMBER |

331419 |

|||

|

REPORTING OFFICER |

Phillip Chapman, Accounting Officer |

|||

|

AUTHORISING OFFICER |

Phillip McMurray, General Manager |

|||

|

RELEVANCE TO COMMUNITY STRATEGIC PLAN |

|

|||

|

FINANCIAL IMPLICATIONS |

There are no Financial implications associated with this report. |

|||

|

LEGISLATIVE IMPLICATIONS |

There are no Legislative implications associated with this report. |

|||

|

POLICY IMPLICATIONS |

There are no Policy implications associated with this report. |

|||

|

1. Correspondence - Minister for Local Government - Rates Harmonisation ⇩ |

|

1. ORDINARY RATES In accordance with the provisions of Section 535 of the Local Government Act, 1993 Cootamundra-Gundagai Regional Council hereby resolves to make the following rates for the 2020/21 rating year: a) Farmland Category Rate of 0.2102605 cents in the dollar, with a base amount of $307.11 per assessment, for all rateable land within the Farmland Category in Council’s area, as defined in Section 515 of the Local Government Act, 1993 based upon the land value at a base valuation date of 1st July, 2019. The base amount for the Farmland Category is estimated to realise 10.59% of the total yield in this category. b) Residential Category Rate of 0.4881518 cents in the dollar, with a base amount of $307.11 per assessment, for all rateable land within the Residential Category in Council’s area, as defined in Section 516 of the Local Government Act, 1993, based upon the land value at a base valuation date of 1st July, 2019. The base amount of $307.11 for the Residential Category is estimated to realise 45.47% of the total yield of this category. c) Business Category Rate of 1.2009279 cents in the dollar, with a base amount of $307.11 per assessment, for all rateable land within the Business Category in Council’s area, as defined in Section 518 of the Local Government Act, 1993, based upon the land value at a base valuation date of 1st July, 2019. The base amount of $307.11 for the Business Category is estimated to realise 19.68% of the total yield of this category. d) Mining Rate of 0.210 cents in the dollar, with a base amount of $307.11 per assessment, for all rateable land within the Mining Category in Council’s area, as defined in Section 517 of the Local Government Act, 1993 based upon the land value at a base valuation date of 1st July 2019.

|

Introduction

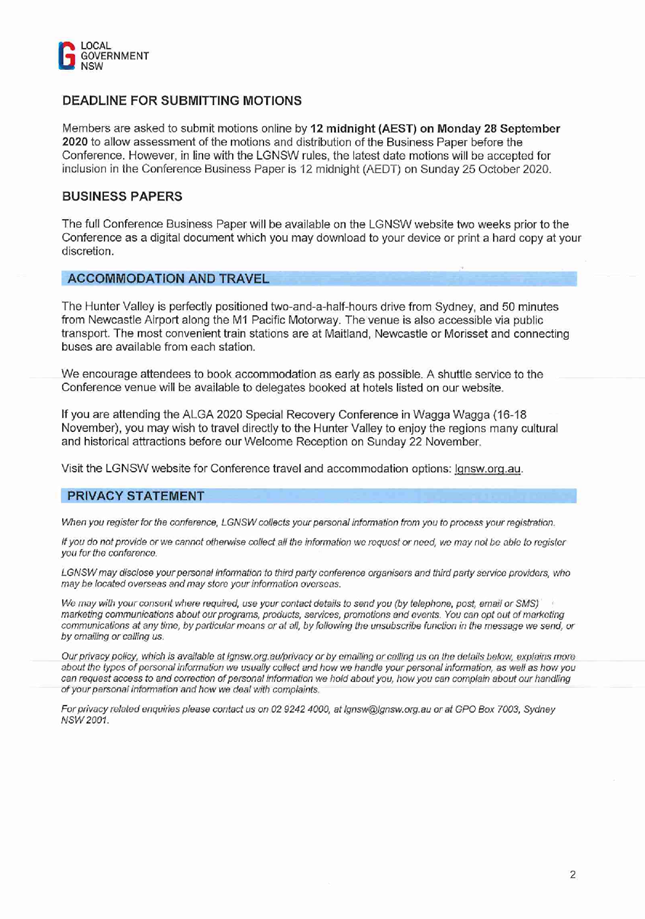

Section 535 of the Local Government Act, 1993 requires that rates and charges must be made by resolution of Council.

Discussion

The provisions of Section 532 of the Local Government Act, 1993 specify that a council must not make a rate or charge until it has given public notice (in accordance with Section 405(3)) of its Draft Operational Plan for the year for which the rate or charge is to be made and has considered any matters concerning the Draft Operational Plan (in accordance with Section 405(5)).

Council has fulfilled the public notice obligation and the

rates and charges for 2020-21

must be adopted by Council.

In accordance with the Proclamation relating to the creation of Cootamundra-Gundagai Regional Council and the Local Government Amendment (Rates—Merged Council Areas) Bill 2017, a four-year rate path freeze applied to Council from 2016/17 (until the end of the 2019/20 rating year).

This period has now expired, and the former structures of the former councils’ areas pertaining to rates and charges have been amalgamated and harmonised.

The Independent Pricing and Regulatory Tribunal (IPART) has

determined that Council’s

general income may be increased by 2.6% under Section 506 of the Local

Government Act, 1993 for the rating year commencing 1st July,

2021. This increase has been applied to

the notional rate incomes of each of the former Councils.

The Special Rate Variation previously approved for the former Gundagai Shire Council will be retained in Council’s general income base for 10 years from June, 2014, and from 1st July, 2024, Council’s general income will be reduced to what it would have been without the special rate variation.

Correspondence received from the Minister for Local Government, the Hon. Shelley Hancock, MP details that the Government has no intention of introducing a staged approach to rates harmonisation. Further, deferral of the rates harmonisation would require a formal application to be sent to the Minister with no guarantee of a response which would keep Council within the legislated timeframe. As such, Council has little option but to adopt the recommended harmonisation.

|

28 July 2020 |

|

DOCUMENT NUMBER |

331495 |

|||

|

REPORTING OFFICER |

Phillip Chapman, Accounting Officer |

|||

|

AUTHORISING OFFICER |

Phillip McMurray, General Manager |

|||

|

RELEVANCE TO COMMUNITY STRATEGIC PLAN |

|

|||

|

FINANCIAL IMPLICATIONS |

The annual rates and charges budget. |

|||

|

LEGISLATIVE IMPLICATIONS |

There are no Legislative implications associated with this report. |

|||

|

POLICY IMPLICATIONS |

There are no Policy implications associated with this report. |

|||

|

Nil |

|

WASTE MANAGEMENT CHARGES In accordance with the provisions of 535 and 501 of the Local Government Act 1993, Council hereby resolves to make the following waste management charge for the 2020/2021 rating year : Commercial Waste Management Charge of $456.00 per service for the removal of waste (one 240 litre general waste pickup per week and one 240 litre recyclable waste pickup per fortnight) from Non-Residential properties for which the service is requested and available. Multiple services will be charged for multiple bins and/or multiple collections per week.

|

Introduction

Reference is made to Council Resolution 169/2020 of 30 June 2020 making the 2020/2021 annual charges.

Discussion

The 2020/2021 Commercial Waste Management charge as detailed in Council’s 2020/2021 Operational Plan was not included in the aforementioned resolution, and accordingly is now detailed above.